llc s corp tax calculator

1 Select an answer for each question below and we will calculate your LLC tax savings. Previous bankruptcies tax liens.

Estimated Local Business tax.

. How Will A Business Tax Calculator Help Small Businesses. The SE tax rate for business owners is 153 tax. Pozent Corporation in Piscataway NJ received a Paycheck Protection Loan of 325000 through JPMorgan Chase Bank National Association which was approved in April 2020.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. LLC S-Corp C-Corp - you name it well calculate it Services. We are not the biggest.

Gross to Net Net to Gross Tax Year. Find out why you should get connected with a CPA to file your taxes. Our small business tax calculator has a.

Business Profits Tax fixed 82 of net income. Annual cost of administering a payroll. Start Using MyCorporations S Corporation Tax Savings Calculator.

The LLC tax rate calculator is used by corporations to calculate their taxes. A Business Filing Details. Lets start significantly lowering your tax bill now.

Our simple application process can be completed within minutes. Lets calculate your canadian corporate tax for the 2020 financial year. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

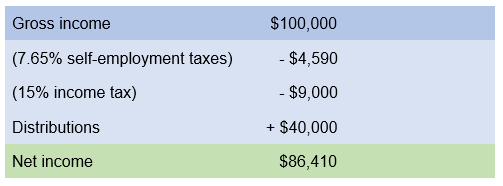

Publicly traded partnerships that were. Forming an S-corporation can help save taxes. This application calculates the.

Annual state LLC S-Corp registration fees. S corp owners must also pay. Total first year cost of S-Corp.

Use this calculator to get started and uncover the tax savings youll. This calculator helps you estimate your potential savings. Social Security and Medicare.

Corporate tax rate calculator for 2020. OLPMS - Instant Payroll Calculator. Taxes are determined based on the company structure.

In that ruling the agency addressed the issue of whether an S corporation can convert to an LLC file an election to retain its tax treatment as a corporation and also hold onto its S status. Form 1120 or the taxable income of last year. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. From the authors of Limited Liability Companies for Dummies. Minimum Fee applicable to businesses with 500000 in property and sales.

Alpha Finance Corporation is a leading alternative finance company based in New Jersey. S-corporations are exempt from the Business Corporate Tax but they are still subject to the General Corporation Tax or Banking Corporation Tax.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

How To Calculate Tax Liability As A C Corp Hall Accounting Co

Business Entity Comparison Harbor Compliance

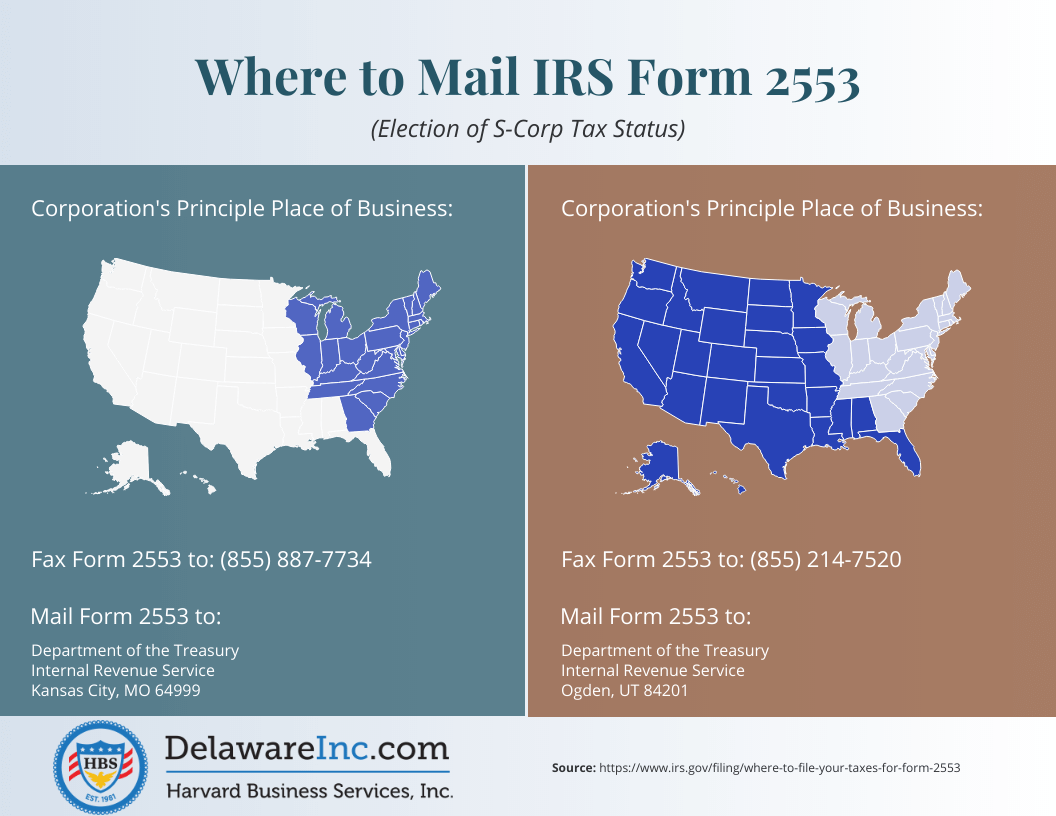

Filing S Corp Status On A New Delaware Corporation Harvard Business Services

S Corp Rias Disadvantaged By The Tax Bill Mercer Capital

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Discover How Incorporating An Llc Can Save Money On Taxes

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Calculate Your S Corporation Tax Savings Zenbusiness Inc

%20Image%20(GD-665).png)

Small Business Tax Calculator Taxfyle

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Vs Llc Everything You Need To Know